About the Company

Kanak House Bullion (House Of Gold) is an online trading International Bullion House dealing with Precious Metals and Specializing in all aspects of Bullion Buy and Sell Transactions. Our experts have in-depth experience in a broad range of our services ensuring our clients capture the best opportunities in gold trading and silver trading by investing online. Our Clients can deal with physical along with online trading of Precious Metal bars and coins (Gold, Silver, Platinum & Palladium) through their purchase or sale in units of ounces, or kilograms.

Our premium locations across the globe help us spread our corporate network rapidly and help customers to grab great opportunities through online trading.

About the Company

Kanak House Bullion (House Of Gold) is an online trading International Bullion House dealing with Precious Metals and Specializing in all aspects of Bullion Buy and Sell Transactions. Our experts have in-depth experience in a broad range of our services ensuring our clients capture the best opportunities in gold trading and silver trading by investing online. Our Clients can deal with physical along with online trading of Precious Metal bars and coins (Gold, Silver, Platinum & Palladium) through their purchase or sale in units of ounces, or kilograms.

Our premium locations across the globe help us spread our corporate network rapidly and help customers to grab great opportunities through online trading.

Our Products

Our Products

Gold Savings Plan

Gold is Never Expensive to buy

1 Gram Gold Bar

24k (999.9 Purity)-

Inclusive of Insurance

-

Inclusive of Certification

-

Free Delivery within UAE

-

BuyBack at Same Price

-

Freedom To Upgrade

2.5 Gram Gold Bar

24k (999.9 Purity)-

Inclusive of Insurance

-

Inclusive of Certification

-

Free Delivery within UAE

-

BuyBack at Same Price

-

Freedom To Upgrade

5 Gram Gold Bar

24k (999.9 Purity)-

Inclusive of Insurance

-

Inclusive of Certification

-

Free Delivery within UAE

-

BuyBack at Same Price

-

Freedom To Upgrade

10 Gram Gold Bar

24k (999.9 Purity)-

Inclusive of Insurance

-

Inclusive of Certification

-

Free Delivery within UAE

-

BuyBack at Same Price

-

Freedom To Upgrade

Why Kanak House Bullion?

Flexible

Every investor is different, which is why we offer a range of gold savings options. Simply choose the option that suits you best

Accessible

Investing in gold with The Kanak House Bullion starts from as little as AED 335, meaning gold is now as accessible as it is appealing.

Secure

When you buy gold from Kanak House Bullion, your gold comes with Insurance. Our Online payments are also safe & secure.

Trusted

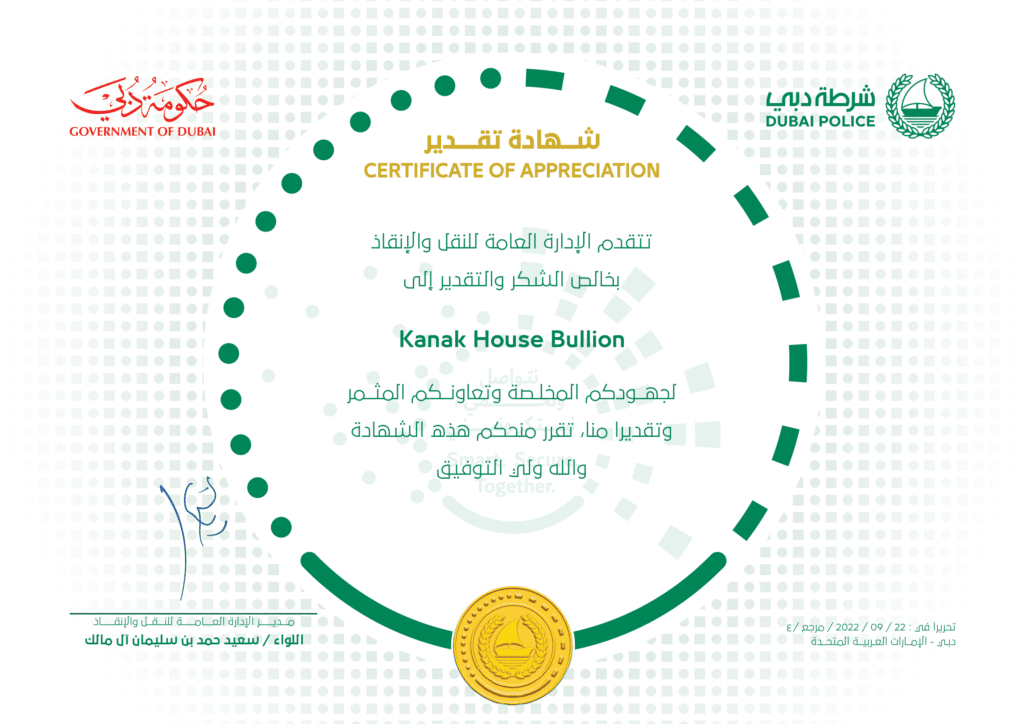

With a history of years, we are one of the most trusted companies to purchase gold and other precious metals online.

Get Started in 3 Easy Steps

1

Create an account

Begin your investment journey by creating a personalized account on our platform. Provide essential details and set up your profile to tailor your investing experience.

2

Fund your account

Once your account is set up, securely deposit funds into it. Choose from various funding options and ensure your account is adequately capitalized to pursue investment opportunities.

3

Start investing

With your funded account, you’re ready to dive into the world of investing. Explore a range of investment choices, make informed decisions, and watch your financial future flourish.

Get in Touch

Found something interesting ? call us to know more or let our experts give you a call.

Stay Up-to-Date with everything Gold.

Sign up to receive the latest market information, products and services from Kanak House Bullion